How Much Does a Retail Point of Sale System Cost?

Point of Sale System options are as vast as ever in this world of technology. Determining how much your system will cost depends on a range of factors, including choice of hardware, software, and peripherals, as well as your method of implementation.

By Dan King, President

Retail point of sale (POS) systems are not only more affordable and powerful than ever, they are the standard of how modern retail stores do business. While electronic cash registers are sufficient to keep track of money, in today’s technological world they are about as efficient and accurate as using a cigar box at your cash wrap. A modern POS system comes packed with features that will help you increase efficiency, speed up checkout times, improve customer experience, track spending and sales, and most importantly, save you and your business time and money.

It doesn’t matter if you operate a single, small-scale location, a national chain with thousands of locations, or anything in between. You can now find a POS system that fits your needs in a broad price range that starts at $0.00 (though nothing is really free) and goes up from there. It is like buying a truck: if you get a base two-wheel-drive model it might start in the $20,000 range but for the same truck with the off-road, luxury, or sports packages, the costs can easily double or even triple.

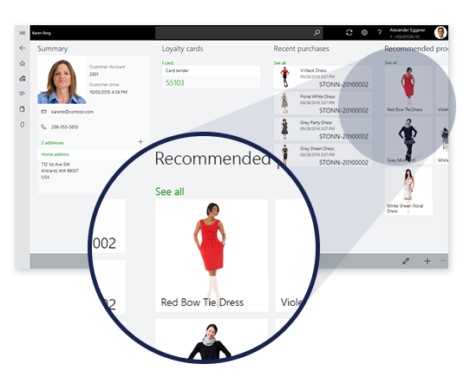

With all of the POS software options today including on-premise, hosted, cloud, software as a service (SaaS), and mobile, an answer to the question of how much a POS system costs is more nebulous than ever. One must decide on the architecture and delivery methodology as well as the features the software and hardware must offer to meet your specific business needs. While most software solutions in the market today are either on-premise or cloud-based, there are a few designed as hybrids that allow a mix of on-premise and cloud in the same solution including mobile and clienteling capabilities.

Most retail POS systems have an upfront cost but it’s only a matter of time before the investment pays off. Once you understand all a POS system can do for your business, you’ll probably agree that not having one would be too costly.

The benefits of a point-of-sale system include:

• Better Efficiency: Buying the right retail POS system is like hiring an overachieving new employee. Put your system to work managing purchase orders, tracking sales trends in real-time, generating reports, and making sure customers get in and out quicker with fewer transaction errors.

• Improved Customer Relations: How do you turn a shopper into a customer? By treating them right and giving them what they want. A retail POS system can help you do just that. By speeding up transactions, your staff can spend more time on the floor interacting with customers. Plus, retail POS solutions can help you track shopping trends, allowing you to offer customers more of what they’re interested in through incentive and loyalty programs, gift cards, and charge accounts.

• Enhanced Security: With credit card data thieves coming up with ever more elaborate schemes every day, you need to step up your security game as well. Make sure you are protecting your business and your customers by running the most sophisticated anti-credit card fraud software available today on your new retail POS system.

• Stronger Profit Margins: This advanced functionality would be meaningless if it didn’t help your business do what it’s supposed to do – turn a profit. Retail point of sale software will help you to identify which items are selling (and which aren’t), when your peak sales times are, where and how products should be displayed, and other important sales trends. Understanding these retail sales factors will also help you craft incentive and loyalty programs to keep customers coming back. You may even create new revenue streams by introducing point-of-sale advertising on the customer display screen.

Convinced that a point of sale system can help your business? Below are some sample retail POS system costs that will help you take the next step. There are primarily three things that have costs to consider as you invest in a POS solution: hardware, software and professional services.

Point of Sale Hardware

Regarding hardware for the POS registers, the back office manager workstation, and/or a shipping and warehouse station, the costs will range from roughly $1,000 to $5,500 per workstation, depending on specifications and features. For the POS register, you will need a PC or Mac, a laptop, an All-in-One machine (AIO is our recommendation), or a Tablet as a core processing machine.

You can expect to pay approximately $1000 and up for a basic PC or Mac in a traditional consumer or business class use configuration. You will want to ensure before purchasing the software compatibility with your chosen operating system (Windows, iOS, or otherwise). These stand-alone machines generally have a lower initial cost, a broad range of manufacturers, and can easily be swapped as needed as they are readily available at electronics resellers and on the web. The drawback to these stand-alone PCs is that they lead to disparate pieces all strung together with cables often making a “rats nest” and needing their own power outlet to run. Since these are line of business (LOB) machines expected to run long hours every day, using a less expensive consumer class machine can set you up for disruption.

Let’s say you save $500.00 on a computer and within the first year or two if fails. Even if it is under warranty the soft costs of losing time, disrupting the experience for the customer, and also going through manual processes (which make a break in the audit trail) will outweigh your initial savings. In addition, if you have only one register in your store, a workstation failure can potentially disrupt business for days while replacements are acquired. If you have more than one register, often these solutions have a “master” machine on which the shared database is held. If the master fails and there is not a good or current backup then the results can be disastrous and may take you back to step one in implementing your POS solution. The costs of a failure in production will dwarf any savings from buying consumer-class equipment. For these reasons and more, investing in business class machines designed to work 24/7 for years is well worth the upfront investment.

An All-in-One (AIO) machine costs can range from $1,200 to $3,500 per workstation. However, AIOs offer many features, making the additional cost worthwhile. For starters, they are business-class machines (in most cases) and designed for the rigors of a LOB machine in challenging environments like Retail, Grocery, Restaurant, and Warehouse environments. Often times these environments are fraught with things to consider. Restaurants are greasy and in most cases, no consideration of ergonomics or simply space required has been given before counters and offices are built out. The same is true of many other environments and the POS gear is delegated to places with bad airflow, close to areas with liquids and food, and locations that are hard to clean. AIO machines are designed to work with less airflow, are ruggedized to withstand liquids, and are able to handle human abuse. AIOs also often have other peripherals like printers, touch screens, Bio-Metric authentication devices, and scanners attached and built into one chassis with a small footprint. This can reduce visible cabling, decreasing the number of power plugs required and taking very little counter space. This space efficiency can pay for the higher cost by itself if that additional space can be used to merchandise products or allow for a smaller cash wrap overall. Obviously, square footage is a considerable piece of overhead for any retailer, and reducing the “technology” a customer sees has advantages. Many companies go to great efforts and expenses to create a comfortable environment for their customer experience. Having a bunch of visible hardware and wires can be disrupting to that experience.

Tablets have advantages as well for some environments and come in many sizes and brands. Again, in most cases, it pays to invest in gear that is designed for business and ruggedized. Tablet costs range from below $1000 to over $2,000. As is the case with the rest of your hardware and software choices, you will want to confirm compatibility prior to purchase. Advantages of a tablet POS are mobility, small footprint, wireless, battery power, and the ability to perform multiple tasks from front to back office including sales, inventory counting, product shipping, and receiving. For this reason, getting a ruggedized device that can handle being bumped and dropped will have long-term value.

There are many options in terms of POS hardware peripherals, with a variety of manufacturers for touch screens, receipt printers, cash drawers, barcode scanners, payment terminals, line displays, customer-facing screens, and change dispensers, label printers, cameras, and customer traffic counting devices. The old adage “you get what you pay for” is definitely applicable when considering how to invest in peripherals. Retailers who have been through this before understand that purchasing ‘Best of Breed’ hardware is well worth the upfront investment. Names like Epson, Zebra, Honeywell, ELO, Touch Dynamic, and HP are manufacturers well known to make top-notch gear that lasts for many years, so you can invest once and spend your time and money on your business going forward.

Point of Sale Software

Software is the foundation of the POS Solution and drives what kind of hardware you need and what features your business can take advantage of to drive workflow, as well as shape your customer and employee experience. It is the most important part of your decision process to choose which software solution and delivery partner in which to invest. If you get a piece of hardware that goes bad or you don’t like, it is pretty easy to replace. Software on the other hand, once implemented and put into production, is time-consuming and expensive to replace. Not to mention the transaction data, which is the most valuable thing of all, is not easy to migrate into another software. It is also true that you can get good software, but with a bad implementation partner, the final solution can become a mess. This being said, there is much to consider.

Let’s start with one of the more common topics of the day, cloud vs on premise software. Also, a less asked question, what about hybrid solutions?

Legacy POS, on-premise and traditional POS are POS systems that store data on local servers and run on an internal network. An example of on-premise software in the consumer world would be the family photos saved on the desktop of your home computer.

Typically, on-premise POS is sold as a persistent license that you buy and own the rights to use in perpetuity. However, in today’s marketplace, there is likely a recurring cost for monthly or annual software maintenance. These solutions have a higher cost of entry but if kept in production for long periods have a lower total cost of ownership for the software. There are other cost considerations with this model from an infrastructure, upgrade investment, and maintenance point of view as you would have to house servers, ensure access, take security measures and manage backup systems for disaster recovery and business continuity. On-premise software is more like buying a car as opposed to leasing one. These per license costs range from $1,000.00 to $2,000.00 per workstation for a small and medium business (SMB) solution.

Cloud-based, software-as-a-service (SaaS) POS systems are web-hosted solutions that store data on remote servers and make information accessible online. The cloud is everywhere – you access the cloud every time you log in to Facebook, Gmail, or your online banking application. Cloud-based solutions are licensed and sold entirely differently and have a range of approaches. The most common is a per-monthly fee like a cable bill. You keep paying every month or year or the service turns off. Over the long term, these SaaS models have higher costs but the initial price of entry is much lower. They also remove many of the infrastructure costs and efforts mentioned for the on-premise software since the servers are owned, hosted, and managed by the publisher of the solution. Saas POS costs range from 70.00 to 200.00 per month per workstation or user.

Just like in the financial markets, diversification of offerings and implementations work. Retailers are supplementing their core business with retail merchandise that fits their persona. Examples of this are vast. Specialty food retailers are offering tastings to enhance their core retail business. Cafe owners are adding and/or increasing the retail portion of their business to increase sales per customer and build brand awareness. Coffee shops are obtaining liquor licenses to offer wine and craft beers to boost their evening sales.

Hybrid POS is a bit like the diversification of offerings in a retail environment. Hybrid can mean it can be deployed in the cloud and on-premise in a mixed-mode. This is helpful for organizations that are more dynamic in terms of when and where they sell things, such as a craft store that attends trade shows and sells wares outside of the brick-and-mortar store location. From this perspective, hybrid POS solutions can offer local data at the stores with access to the enterprise ERP and cloud-based POS for the more mobile parts of the company. A small handful of solutions are capable of this and are posed to offer a “custom fit” solution to a broader range of merchants. The most dynamic of the solutions, hybrid POS offers the best of all worlds with the ability to host in the cloud or on-premise. Solutions with this robust flexibility are often more feature-rich and offer the ability to adjust the user and customer experience as well. While the costs and models are varied for this solution option, cloud based pricing ranges from $70.00 to $200.00 per month per user or workstation.

Professional Services

Professional services are the final component to the “how much does it cost for a POS” question. Implementation and technical support costs vary from almost nothing, if you are a savvy self-starter and find a package that caters to that, or quite expensive if you have an intricate business and you want to get a POS system with features to match and want to hire internal staff to implement. The most successful implementations, in our experience, have a software partner who specializes in POS, inventory and payment solutions. Working with a professional implementation team will have an upfront cost but also allow the business to implement POS software and hardware solutions faster with more guaranteed results. The cost of these services has a ratio of 1:1 to 1:5 of the POS software cost.

At the end of the day one thing still holds true: you get what you pay for. When looking at the numbers and costs for a POS solution, make sure to think long-term, as we doubt your business plan includes going out of business soon. With the appropriate and properly implemented POS solution, you can set the stage for growth and great success while saving time, automating tasks, storing data for accountability, and providing a great experience for your staff and customers alike.

***

Dan King is the President of New West Technologies, Inc. With over 30 years of point of sale technology experience, his passion is helping retailers find the right software, hardware and technical assistance to make their businesses thrive.